2019 is the year you fall in love with GIC’s.

Maybe that’s a throwback feeling, but for most people, considering GIC’s as a legit investment option is a first.

So, where did they even go?

They’ve been around.

But beginning in the early-90’s and despite two market corrections which wiped out a lot of retirement savings, GIC’s have been been shunned from portfolios. Equity markets are all you hear about in the media and the prevailing message from the investment world is you’re throwing away money by investing in GIC’s.

“I bought a 5-year GIC and slept well” ~ said no one in the last 25 years.

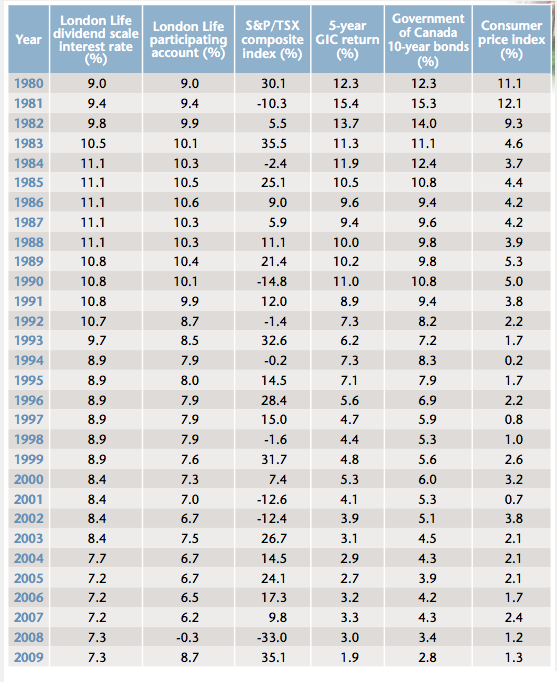

A historical look at GIC rates (courtesy of ratehub.ca) helps frame some of the context around what happened to the perception around GIC’s.

In the decades leading up to the early 90’s, both equity market returns and interest rates (upon which GIC rates are based) were solidly positive and into the double-digits. The path for someone saving for retirement usually had them save and invest ‘till they turned 55 (retirement age once upon a time) and then buy an annuity or GIC to fund 10-15 years of retirement expenses.

By the early-90’s, interest rates accelerated their long downward trek, which wasn’t a terrible problem if you already owned government or corporate bonds and benefitted from the subsequent price appreciation (interest rates and bond prices move in opposite directions), but the incessant decline in rates to nothingburger levels has resulted in problems for those now nearing retirement.

Firstly, the amount of income you can drive from the fixed income side of your portfolio has collapsed. (In 1990, as a retiree, you could lend $100,000 to the Government of Canada and they’d pay you almost $11,000 per year. Today, that same investment gets you a whopping $1,750 per year)

Secondly, bond prices would come under pressure IF interest rates rise. The resulting loss in value would offset whatever stable interest income you’re actually generating for yourself.

Here’s the iShares 1-5 laddered corporate bond ETF as an example, where the modest 2% cash yield it generates each year has been almost fully offset by the decline in value of the bonds held in the ETF.

GIC’s are a bit different from bonds.

There is no price risk with them. Meaning, if you buy a GIC for a $1000, the amount the GIC is worth is not impacted if interest rates rise. You’ll get $1000 plus your interest payments back, guaranteed. Most (not all) GIC’s have the additional benefit of being insured through the Canadian Deposit Insurance Corporation (CDIC) up to $100,000 per account.

With non-redeemable GIC’s available for in the mid 3% range, I’d happily take those returns and chill as opposed to worrying about price, duration and credit risk with bond holdings.